If you’ve been (wisely) keeping yourself away from the greater mainstream media miasma, you may not have heard about the book that’s been causing “conservatives” and Libertarians to foam at the mouth and in general go pretty fuckin’ apeshit. French economist Thomas Piketty’s Capital in the Twenty-First Century is a match to dry drought-brush causing a veritable meme-fire, chasing out rats and other rodents from their hiding places.

is a match to dry drought-brush causing a veritable meme-fire, chasing out rats and other rodents from their hiding places.

It’s been fun to watch their worldview get annihilated by facts. Numbers don’t lie—but politicians do. The likes of Rep. Paul Ryan have no cover anymore. They’re holding their shticks, so to speak.

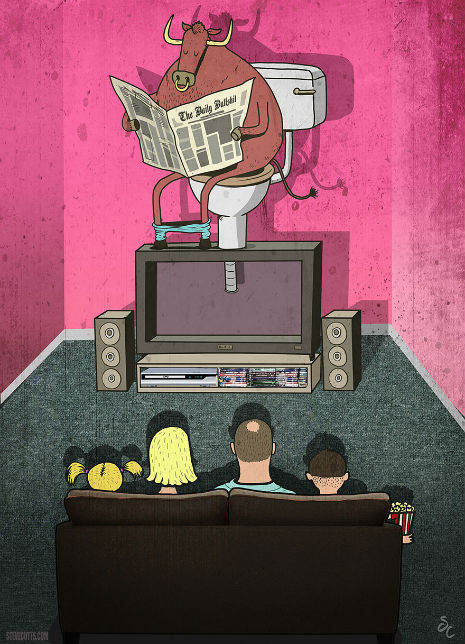

Piketty’s story makes effective use of graphs, data and highly quantitative analysis, with his conclusion being about as blunt and straightforward as a two-by-four to the back of Rush Limbaugh’s giant butter-sculpture of a head. To put it succinctly, Piketty has proven what we probably already knew: Economic growth, in developed countries like the US, has become increasingly “owned” and funneled into the gaping maws of the 1%, and is largely fueled by increasing levels of debt for all the rest of us. In other words, for the last couple of decades we’ve moved into a sort of flesh-eating bacteria version of economics that isn’t floating anyone’s boats except for a tiny minority, who are using their economic power—their capital—to grab all the benefits of growth for themselves.

But this isn’t too surprising and it’s not really what has both left and right flipping out about. The REALLY BIG STORY is about inherited wealth. In other words, that 1% we keep talking about aren’t the God-annointed uber-successful genius entrepreneurs that the Fox News types always claim they are. They aren’t the hallowed Atlas shrugging “job creators,” either. Nope: That 1% consists overwhelmingly of people who inherited their wealth, and are now using that vast amount of capital to grab any additional growth for themselves, locking out the “little guy” out in the process.

Great system we’ve got here: One baby is born with barely a pot to piss in, but another one—well 1% of babies at least—hits the fucking jackpot through an accident of birth. The other 99% are on their own!

Since the Reagan era relaxed financial and banking laws have made it ever and ever easier for enormous globs of capital to attract even more enormous globs of capital—often without doing any real “work” or creating much of anything save for more money, while smaller players got knocked out, sent to work at Walmart or some non-unionized service industry where they will never be able to accumulate enough capital themselves to ever start their own business again. With a de-capitalized and unempowered middle class, there’s not a lot of real growth around so the uber-wealthy have worked very hard to “own” what little growth there is out still out there to siphon off, stripmining the rest of the economy for whatever else they can using a mindboggling array of debt instruments: Leveraged buyouts and private equity along with consumer credit cards, mortgages, student loans, CDOs, CMOs and all sorts of other debt that funnels even more capital to the 1% without creating any real growth. They’re using your credit card debt, your mortgage and your student loans to make you work for their enrichment.

Job creators? Bullshit.

The middle class are the job creators and they are rapidly going off line for lack of access to capital. Their would be customers are broke, too. Nobody wins except for you-know-who!

This is why the Tea party has been programmed to despise the Fed’s quantitative easing program: The 1% that is largely an inheritor class don’t really care about real economic growth all that much. In fact, they don’t like it at all: Growth often comes with inflation, which for an increasingly wealthy middle class isn’t a problem as long as wealth is increasing more quickly than prices. (In fact, most economists believe that some inflation is probably necessary in order to achieve optimal growth.) But if you are a Romney or Koch or Walton who inherited a giant ball of capital, you certainly don’t want to see any inflation because that reduces your standing. I mean, it’s not like trust fund kids create REAL jobs, is it? Any of those shitty minimum wage jobs that “capitalists” crow so proudly of having created probably came about because they eliminated many more higher-paying jobs, by using their vast (and otherwise useless, ‘cause they CAN’T spend it all) capital to buy politicians and twiddle the laws in their favor.

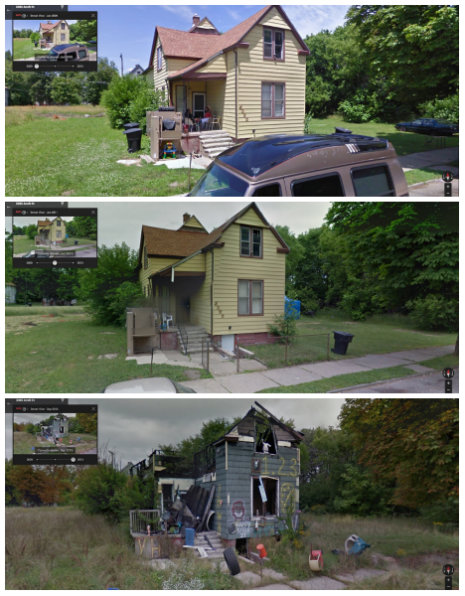

Anyway, this grabbing of the growth by the inheritor class manifests itself in all sorts of heinous abuses of the political and economic system, but one obvious way that pops into my mind is in the real estate market. In major markets like New York and London, rents and housing costs have skyrocketed, completely out of proportion to average wages. And why? Because the uber-wealthy have so much extra cash that they dump it into real estate that neither they nor anybody else uses. Indeed, fancy neighborhoods in London like Mayfair are becoming veritable ghost towns, filled with empty houses and apartments (unless the squatters, God bless ‘em, get in there!). I remember looking at an apartment on Prince Albert Road and the doorman complained that the entire building was usually empty. But the point is that all that useless money is in effect getting speculatively dumped into real estate and the result is… nothingness. Empty neighborhoods. The oligarchs aren’t even eating in the local ritzy restaurants, because they’re someplace else. They also forced out the merely “rich”!

To sum up: Capital has become so concentrated in the hands of a tiny minority of people that those who own it can never make use of it efficiently. How could they? They inherited it after all which means they may have no business sense whatsoever aside from hiring the right people to work the system into vomiting out more capital into their cupped hands and opened mouths.

As a result, real growth (ie, not driven by middle class debt or the other myriad pyramid schemes of the super rich) has plummeted and the vast majority of middle class people have seen their standard of living slide backwards and access to the capital and tools with which in times past they may have enriched themselves has been forcibly pulled from having any practical possibility of enriching their lives! This goes way beyond mere “fairness” after all, as the new overlord “rentier” class increasingly block access to that which the middle class needs to have in order for real overall wealth to grow!

The “lumpen capitalists” have absolutely no interest in your social advancement, Jack.

In 19th century China something similar happened, and the consequences were dire indeed. Arable land (which is in effect “capital” in an agrarian society) was increasingly concentrated into the hands of a shrinking number of people. Eventually, everyone was so damned poor that by the end of the Qing dynasty even the long-suffering Chinese had had enough: 50 years of revolution later and Mao and his posse were large and in-charge. And aside from the fact that there are some who argue that Mao’s minuses (eg, the Great Leap Forward and the Cultural Revolution) eventually outweighed his pluses, just getting there was no picnic.

Is that what we really want? Lots of folks say they want a revolution until they discover what living through one is actually like. Put in another way, we need some redistributive schemes now—Piketty says nothing short of an 80% wealth tax, enforced globally, will do it—or else the redistributive schemes twenty years from now will probably be far less pleasant for everyone concerned.

Below, Thomas Piketty speaks about his work with Justin Vogt, deputy managing editor of Foreign Affairs: