U.S. growth prospects deemed bleak in new decade. A dismal job market, a crippled real estate sector and hobbled banks will keep a lid on U.S. economic growth over the coming decade, some of the nation’s leading economists said on Sunday.

And by leading economists, they mean Joseph Stiglitz, he of the Nobel prize, and people of that rarefied caliber. Here, have some more:

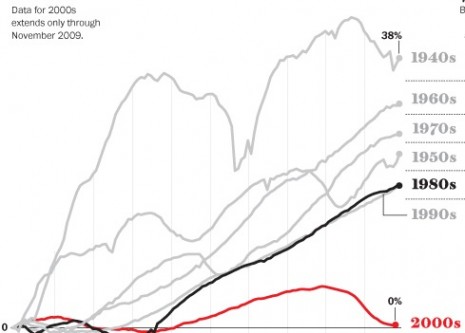

Many predicted U.S. gross domestic product would expand less than 2 percent per year over the next 10 years. That stands in sharp contrast to the immediate aftermath of other steep economic downturns, which have usually elicited a growth surge in their wake.

“It will be difficult to have a robust recovery while housing and commercial real estate are depressed,” said Martin Feldstein, a Harvard University professor and former head of the National Bureau of Economic Research.

Housing was at the heart of the nation’s worst recession since the 1930s, with median home values falling over 30 percent from their 2005 peaks, and even more sharply in heavily affected states like California and Nevada.

The decline has sapped a principal source of wealth for U.S. consumers, whose spending is the key driver of the country’s growth pattern. The steep drop in home prices has also boosted their propensity to save.

“It’s very hard to see what will replace it,” said Joseph Stiglitz, Nobel laureate and professor of economics at Columbia University. “It’s going to take a number of years.”

And blah, blah, fucking blah. I’ve read so many articles on America’s decline in the past three years that I’m getting bored to tears with them. I think this will be my last post on the economy for some time. Don’t get me wrong, I’m as convinced as the next guy that everything is in a hell of a mess, believe you me. I’m just sick and tired of reading about it. How many different ways can the media parse the main event: things suck, “the system” has run out of gas and it’s likely to stay that way for a long, long time unless something unforeseen happens.

And like what? What would prompt economic growth in America today? See any likely industrial contenders? Ones that none of the rest of us have heard of?

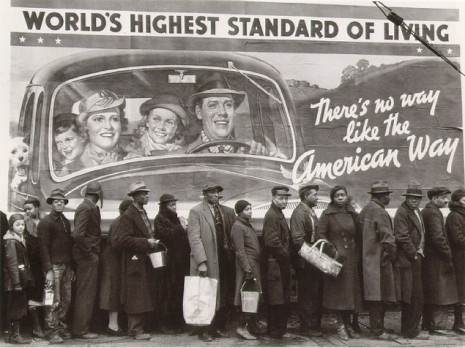

But I’m done with it. I get it and I am over it. I want to start reading reading about what we’re going to DO about it. I mean how will we live? This is what the next conversation needs to be about. While capitalism isn’t exactly finito yet, it’s running on fumes and anyone with half a brain can see that it will be a greatly diminished capitalism moving forward, with the world’s largest economy, run as it is on consumer spending, rampant, unbridled debt and obese greed, now a reluctant mare, unable to drag the rest of the world behind it. Maybe for good this time. We don’t know yet.

And when I read about how the “new” Republican party and these knucklehead teabaggers clamoring for a return to the ideological conservative purity of the Reagan era where all it took was a whopping good tax cut to to right all of our wrongs, I gotta say it, these people seem as dumb as shit to me. Are they living in the same country that the rest of us are living in?

It’s about time America turns off the FOX News and gets used to the idea of Socialism and get used to the idea quickly. Because we can all agree to agree on something—like we’rel doomed—and get organized—fast—or people are going to get hurt, and go hungry and lack health care. How much longer can the government wait before they start to at least make plans to make plans about all these stubbornly unemployed people?!?!

Here is a handful of articles from recent weeks that are coming at it from different angles, but they all agree that things suck and we better get used to it:

U.S. growth prospects deemed bleak in new decade (Reuters)

A Decade of Self-Delusion (Pat Buchanan writing in Human Events)

An Empire at Risk: How Economic Weakness Endangers the U.S. and The U.S.-China Economic Partnership is Through (both by Niall Ferguson, writing in Newsweek)

So there you have it. Case closed. Happy New Decade and probably at least part of the one beyond that barring some sort of unexpected miracle.

What are we going to do next? How are we going to live? This is what we need to be asking each other.

Talk amongst yourselves. And play nice.

Posted by Richard Metzger

|

01.04.2010

08:39 pm

|