Our favorite story gaining traction around the Interwebs today has to do with Anglican priest Rev. Tim Jones, who more or less told his congregation that it’s OK to steal from retail giants like grocery chain Tesco if your family is hungry. Makes sense to us, but Rev. Tim (who is not as liberal as it might seem) has been taken to task by conservative politicians and some in the British media for advocating this teensy-weensy exception to the 8th commandment. Here’s what he told his congregation:

“My advice, as a Christian priest, is to shoplift. I do not offer such advice because I think that stealing is a good thing or because I think it is harmless, for it is neither.

“I would ask that they do not steal from small family businesses but from large national businesses, knowing that the costs are ultimately passed on to the rest of us in the form of higher prices. I would ask them not to take any more than they need. I offer the advice with a heavy heart. Let my words not be misrepresented as a simplistic call for people to shoplift.

“The life of the poor in modern Britain is a constant struggle, a minefield of competing opportunities, competing responsibilities, obligations and requirements, a constant effort to achieve the impossible. For many at the bottom of our social ladder, lawful, honest life can sometimes seem to be an apparent impossibility.”

It’s not like Rev. Tim is saying “Go forth and mug people” or that the poor should burgle their neighbor’s homes. He’s basically saying “feed yourself, illegally if you must, just do it in a way that doesn’t harm society.” Given the choice between starving or allowing your family to starve, shoplifting a frozen pizza sounds like a morally acceptable no-brainer to us in these troubled times.

Here’s Air America’s list of the top ten companies to avoid this holiday season. (Personally, I recommend not buying anything, and instead actually spending time with the people you care about and doing nice stuff for them, but then we can’t dispense with capitalism all at once can we? Oh wait, of course we can… it’s already dead! It’s kind of like “Sixth Sense”... “Some ghosts, they walk around, thinking they’re alive, but they’re actually dead, they just haven’t realized it yet…”)

1. Children’s Place: “It gets its products from places with human rights and labor violations and had to pay $1.5 million in a settlement alleging that they violated the Securities Act.

2. Hanes: “...went the extra step to be cited for ?

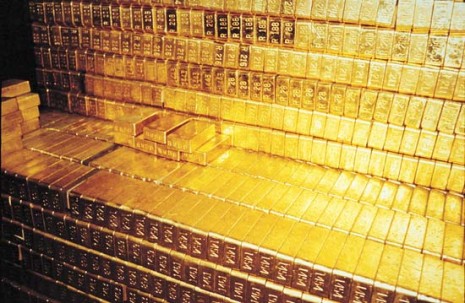

Survivalists beware. The Raw Story reports that we have now hit Peak Gold:

Since starting its slide in 2000, the world-wide production of gold has finally hit “terminal decline,” according to reports citing Barrick Gold, the largest gold miner in the world.

In an interview with The Daily Telegraph during a London gold conference, Barrick President Aaron Regent said that one could argue that Earth has reached “peak gold,” as new supplies of the ore are increasingly difficult to find.

“The supply crunch has helped push gold to an all-time high, reaching $1,118 an ounce at one stage yesterday,” the paper noted. “The key driver over recent days has been the move by India’s central bank to soak up half of the gold being sold by the International Monetary Fund. It is the latest sign that the rising powers of Asia and the commodity bloc are growing wary of Western paper money and debt.”

The report continued: “China has quietly doubled holdings to 1,054 tonnes and is thought to be adding gradually on price dips, creating a market floor. Gold remains a tiny fraction of its $2.3 trillion in foreign reserves.”

Of course today is Friday the 13th, but there is another Friday coming soon that more Americans seem to be interested in: “Black Friday,” the ominously named sales event that takes place the day after Thanksgiving. And no, Black Friday doesn’t refer to the possibility of being stampeded to death by throngs of impatient shoppers; it’s the day when retailers hope to get “in the black” financially, as opposed to being “in the red.” For many stores, Black Friday is the day they reach profitability for the entire year, so the holiday shopping propaganda promoting big sales events is a serious matter, indeed.

Google Trends has been showing strong public interest in Black Friday sales events since Halloween, and with Wal-Mart, Target, Best Buy and other stores seeing their big sales details “leaked” (yeah, right!) on websites like Black-Friday.net and others, this interest seems to be reaching a fever pitch. According to various studies, up to 50% of all shopping done during the holiday season is not for gift-giving, but rather purchases made on the bargain shopper’s own behalf. Of course it only makes sense to put off purchases of big-ticket items like flat-screen TVs and laptops until they are the cheapest they’ll be all year. This season, like Christmas 2008, the sales story that many seem to be interested in is how low Blu-ray DVD players will go in price, with predictions of several retailers offering the players for as little as $49. Target and Wal-Mart are also expected to sell Blu-ray discs for as low as $8.99.

Target seems willing to make the deepest discounts, offering shockingly low prices on many appliances, with items like pressed sandwich makers, coffee machines and slow roasters getting a markdown to—are you ready for this?—$3! The idea is to get as many shoppers as possible into stores with these low, low prices and hope that they’ll be susceptible to make many more purchases. Sounds good in theory, but $3 for a coffee maker? Clearly Target would be losing money on each and every sale. A savvy shopper would simply buy one or two items in one store and mosey on over to the next price-slashing emporium to pick up a few more, avoiding the temptation to spend money on anything he or she didn’t specifically come for.

This may sound, er, un-American, but if household penny-pinching this season is anything like 2008’s totally bust Christmas shopping spree, there may be a different meaning for Black Friday this year after all the dust settles.

Cross posting this from Brand X

Michael Panzner is the author of the new best-seller, When Giants Fall: An Economic Roadmap for the End of the American Era. He’s a former Wall Street insider himself and one of the very, very first writers to accurately predict where the economy was headed in his 2007 book Financial Armageddon

. His views are refreshingly “agnostic” when it comes to matters of liberal vs conservative, and this prevents his analysis from being muddled by an ideological lens. Visit his Financial Armageddon blog. (Note: There are several spots of troublesome audio, but it’s worth getting past them to hear what Michael has to say in this fascinating discussion.)

Not content to put the mom and pop stores out of business, the Bentonville, Ark., behemoth now wants to bury funeral homes. This is not some kind of zany Halloween marketing hoax—at least that we know of. Wal-Mart, the world’s largest retailer, is now selling ... discount coffins. In the “For the Home” (?) area on the Wal-Mart website, feast your eyes on its entire line of inexpensive caskets and even urns, for all of your bereavement needs.

The prices of the Wal-Mart caskets are to die for. All but one of the coffins sells for under $2,000. The deluxe Sienna Bronze model sells for a still bargain-basement—in casket terms—price of $2,899. One of the least expensive model is the still lovely Lady de Guadalupe Steel Casket (see above) at $895. Another design sports a carving of “The Last Supper” by Leonardo da Vinci.

Wal-Mart will even deliver the coffins directly to the funeral home of your choice within 48 hours, but there is a catch: They won’t accept returns unless the product has been damaged in transit. So make sure your loved one is actually dead before you order!

Cross posting this from Brand X

Our super smart friend Charles Hugh Smith posts another must-read essay at his Of Two Minds blog:

When it comes to post-bubble retraces, the fundamental reasons may not matter as much as the technical case for a full reversion to pre-bubble prices. We all know the fundamental reasons why housing shot up—a credit bubble of epic proportions plus securitization, fraud and low interest rates, to name but a few factors—and why housing has plummeted: foreclosures and inventory are rising, tightening of credit standards by private lenders, etc.

But the ultimate predictor of price is technical: speculative bubbles retrace to their pre-bubble prices, or in many cases even crash below those levels.

Those arguing the fundamentals are always grasping at various straws to support the case that prices won’t drop all the way back to pre-bubble levels, and they’re always wrong.

Read more at Of Two Minds

Dangerous Minds pal Marty Beckerman just sent me his new article, “Kill Fatty,” a proposal of Swiftian proportions:

Overweight people are fucking abhorrent, which seems like an obvious and uncontroversial statement, but you cannot turn your head these days without gawking at the vile cascades of shapeless distended flesh that ubiquitously engulf your grotesque countrymen.

Look at these nauseating statistics:1. 33 percent of Americans are overweight, according to the federal government.

2. Another 34 percent are obese, which is even worse.

3. Six percent are ?

I am somebody who watches the price of gold rather closely—it’s actually the second thing I look at in the morning. We have no clocks in this house, so the first thing I do when I get out of bed is glance at the time in the corner of my computer, then click on the gold price widget on my desktop. When the price of gold wildly shoots upwards, it tends to mean that bad things are coming. But many times, such rocket-like fluctuation can be ascribed to group-think investor paranoia—or some barely justified Wall Street exuberance when gold drops in price—rather than any game-changing economic event. To be clear, I am very pro-gold, and think it’s a good solid investment, but I have watched it closely enough over the past few years to see the price drop even as the fundamentals of the economy got worse and worse. The opposite is supposed to happen. The price of gold does not change as “whimsically” as stock prices do, although gold is still most certainly subject to investor “moods”—moreso than any other commodity. That’s sort of the point, I suppose.

Lately gold has been on a bit of a tear with all of the doomsday “High Noon for the Dollar” type headlines and the rumors of China, Russia and the Arab states ending the US dollar’s almighty place in the scheme of “things” as the world’s reserve currency. (I’d wager Matt Drudge and Ambrose Evans-Pritchard must both have sizable gold holdings!).

Dangerous Minds pal Charles Hugh Smith presents a more nuanced view of the dollar’s fate at his Of Two Minds blog:

As the “news” continues to trumpet the decline/collapse of the U.S. dollar, many observers seem to have forgotten that the U.S. dollar is the defacto “shared currency” of the world’s largest economy and its biggest rising-star economy. Yes, the U.S. and the PRC—China. China’s currency (officially the renminbi, a.k.a. yuan) is transparently pegged to the U.S. dollar at about 6.8 yuan to the dollar, down from 8+ a few years ago.

Given that Japan is the world’s second-largest economy by most measures, and that the yen is informally pegged to the U.S. dollar (trading in a band of 90-110 yen for years on end), then it could be argued that the world’s three largest economies all “share” the U.S. dollar.

—snip—

Let’s establish the primary context of China’s leadership: 1 billion poor citizens seeking a better job/wage/life. Here is a puff piece by former U.K. prime Minister Tony Blair which makes one key point: most of China’s citizens are still very poor, and thus the leadership is obsessed with “growth” and jobs above all else: China’s New Cultural Revolution: The world’s largest country has a long way to go, but there’s no question it’s changing for the better. (WSJ.com)

Superficial stories about China are accompanied by glitzy photos of Shanghai skyscrapers and other scenes from the wealthy urban coastal cities, but the fact is that the consumer buying power of China is roughly equivalent to that of England (51 million residents).

Thus those who believe the vast Chinese manufacturing-export sector can suddenly direct its staggering output to domestic consumers in China are simply mistaken: Chinese consumption is perhaps a mere 1/10th of that needed to absorb the mighty flood of goods being produced by China.

Put yourself in the shoes of China’s leadership: what do you care about more: $2 trillion in U.S. bonds or creating jobs for 100 million people? It’s the jobs that matter, and despite its very public complaints about the slipping dollar, perhaps China doth protest too much—or more accurately, for domestic public consumption.

The consequences of a weakening dollar are neutral for Chinese exports to the U.S. but positive for exports to Japan and the European Union. Chinese exports to the EU and Japan have risen sharply in the past nine years, and a weak dollar keeps Chinese goods cheaper than rival exports in these key global markets.

Read More: The Forgotten Peg: Chinese Yuan and U.S. Dollar by Charles Hugh Smith