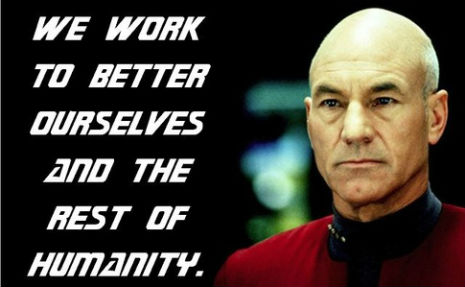

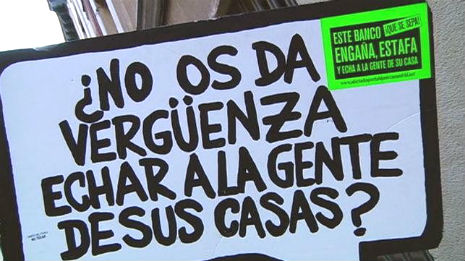

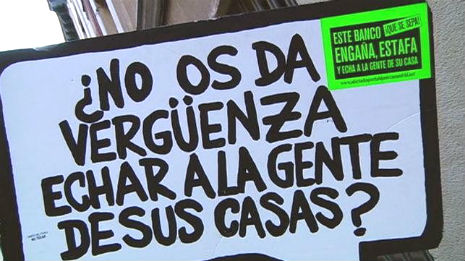

“Are you not ashamed to kick people out of their homes?”

Barcelona, it occurs to me, as our plane descends towards the unfortunately named El Prat, must have some strange and singular relationship to concrete. Due to the national tendency to live stacked up, from above the city undulates in a wild concrete wave—coming to a dead, teetering halt at the brink of the Mediterranean, which meets it with almost parodic calm. Yet, elegant Barcelona somehow manages to make the best out of concrete. Hell, even La Sagrada Familia is moulded from stuff that wouldn’t look out of place in a public housing high rise.

And, ironically enough, it is concrete Barcelona finds its feet encased in, as along with the rest of Spain it sinks to the bottom of the economic ocean…

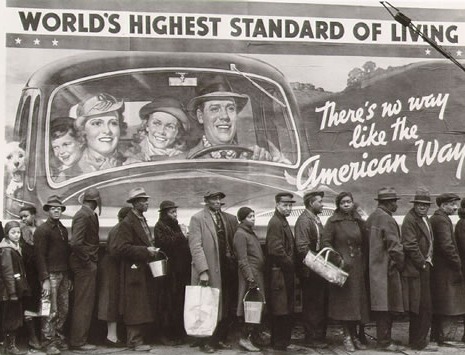

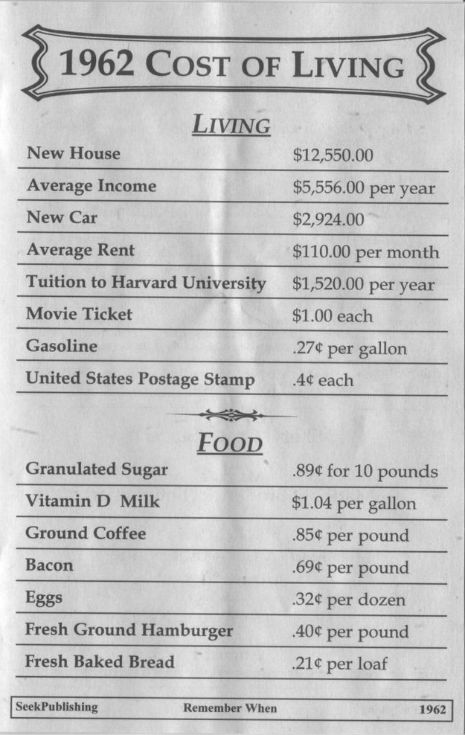

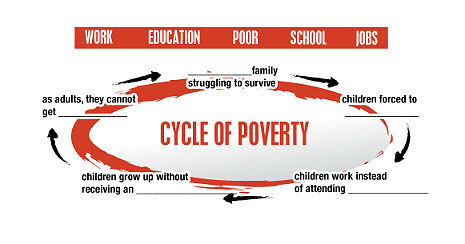

Of all the houses built in Spain between 2001 and 2007 (and there were a lot: this was the property boom that engendered the economic collapse that has left the country with around 26% unemployment, and around 55% youth unemployment) over a quarter stand empty. But despite being dotted with veritable ghost towns, there were over 75,000 evictions in Spain last year, a figure that looks ready to rise in 2013.

Now, in Spain, if a bank kicks you out of your home, seizing your assets, their value is only deducted from your debt. And since the value of Spanish property, post-crash, is a slither of what it was when most evictees bought their properties, and since there were a lot of forty and fifty year mortgages going around, this means many are still expected to pay hundreds of thousands of Euros for an abruptly worthless cube of concrete that will henceforth stand empty, redundant as a sprung trap.

Odd that this should happen in Spain, with its historical antipathy (among a significant portion of its population, anyway) to the very notion of “private property”. “ALL PROPERTY IS THEFT!” declared the anarchist philosopher Proudhon. Well, Spain, you might say, was bound to balk at such daylight robbery. And balk it did, in the spontaneous 15M nationwide protests that marked the proper beginning of what everyone there refers to as the movimiento in the spring of 2011.

Exactly two years later, I am visiting Barcelona to see where the second Spanish revolution is at.

I have, however, a vicious summer cold, and am unsure if my skittish temperature and face full of snot is infecting my view of the city. I’ve heard a lot about how inconspicuous the economic crisis is to the naked eye, but for me, sweating a fever out beneath the first sustained sunshine to touch Catalonia all year, Barcelona seems everywhere composed of two distinct layers.

Along the surreally telegenic beach, for example, there is the expected abundance of tourists, bathers, bars. But there is also, there by the outdoor showers, two apparently underage girls in the early stages of a porn shoot, listlessly palming water at one another’s bikini tops while a photographer snaps and a crowd gawp on.

A random sight, perhaps, but it feels like a symbol.

Further up the promenade we see some anarchist graffiti: “Tourist! Save the planet. Kill Yourself.” Beneath this it reads “Guirifobia Power.” Guiri (sounds like “giddy”), explains Sara Marquez, our friend, hostess and guide to the movimiento, is the derogatory slang for tourist. “There is increasing hostility against visitors—that is, rich foreigners—among some,” she elaborates, for the benefit of this slightly affronted guiri. “As the crisis deepens the only economic sector that really works is tourism. Many feel that the city council is ruling the city thinking in terms only of tourists rather than citizens.”

We stop at a bar for some food—washing it down with cheap beer and tobacco that do my virus few favors. Sara tells us some typical examples of people she knows in the city: University Lecturers earning a couple of hundred Euros a month, and even some doctors and lawyers either unable to get work or earning relatively negligible amounts. Presently in vogue, she says, is the notion of a mileurista—somebody lucky enough earn over a thousand Euros a month. No wonder there is a steady seeping abroad of Barcelona’s young, an exodus massaged by the government, who don’t even bother pretending their homeland has a future for them.

We get up to pay. “Why are you with these foreigners,” the waiter hisses at Sara, “why are you speaking English?” (Earlier today, some respectable-looking old crone had spun on her heel to shout abuse up the street at Sara for the same reason.)

While she tells the geezer where to go, I stand there sniffing and squinting at the street. Rich-looking American girls saunter by in designer shades, swaying honeyed limbs, and platoons of British lads march between bars. But there is also, I note, a continuous quiet traffic of disheveled elderly Catalans and gypsies, all pushing warped trolleys piled with scrap metal. “There seems to be more of this all the time,” says Sara. There is something ominous about the trade, as if they are picking the bones of an economic corpse.

That evening I interview Marc Pradel, an activist and academic. Marc has that air of slightly weary integrity that proliferates whenever a political class manages to entirely monopolise corruption. We begin by discussing the development of the movimiento.

“Two years ago it was as if no one was protesting anything, and then there was this small thing, ¡Democracia Real YA! [Real Democracy Now!], and then this demonstration, and suddenly, surprisingly, everybody came and it was huge. And the last two years, more or less, have highlighted the difficulty in organizing a coherent, conventional political response. There are many things happening at a local level and neighborhood level, a lot of new ideas and discussions, but the movement is in danger of losing momentum unless it can organize.”

I ask to what extent this generation of activists identify with the Spanish libertarian socialist tradition.

“Some parts of the movement are not that conscious of continuing this political tradition, while others are very aware of it, and are openly inspired by Cooperatism and decentralization. Sometimes the movement acknowledges this heritage in a very symbolic way—for instance they tend to organize in columns when they demonstrate, just as the anarchists did in the civil war. But there is also a general awareness they’re not going to solve anything in a classical fashion.”

Yet, on its second birthday, the crossroads the movimiento finds itself at would be readily recognizable to any Spanish anarchist of the 1930s…

Pau Faus, Barcelona PAH

“In Barcelona especially there is a real hostility towards political centralization, a fear of being co-opted, a fear of becoming part of the problem. This is very typical of the social movements here, and I think you can see the continuity from the old anarchism to now, a commitment to decentralization, which can become problematic. Many people say that this movement needs leadership. We do need some kind of organisation, because otherwise you cannot expect major changes. The only time anarchism has been effective is when there was a trade union or something behind it.”

For now, the onus remains entirely on the grass roots.

“There are, in Barcelona and everywhere in Spain, lots of things emerging. For instance we have the community banks: Coop57 is a credit cooperative that gives credit to social projects and gives people the chance to invest in social causes… Som Energia is a renewable energy cooperative… La Fageda is a more traditional cooperative but is very significant in Catalonia. Their workers are handicapped and the company adapts its production accordingly. There are lots of examples of businesses trying to overcome the logic of capitalism.”

He describes the network of community centers, cooperative allotments and squats across Barcelona, created to provide food, shelter, work and support for people. I ask about the state’s response to such initiatives.

“They expect this kind of thing. As long as they’re not attacking some basic things, like the financial system of whatever, they know it can help them, relieve their responsibilities. For instance, if there’s some empty land being cultivated which belongs to the banks, it has no value anyway and if somebody’s growing food it’s helping to solve some social problems. But when there’s a more political approach, or organised protesting, then you find opposition—and often very violent opposition. The level of violence is high. Just to scare citizens—normal citizens—from joining the movement. Because the movement was initially very apolitical, a citizen’s movement with nothing to do with the traditional party politics or allegiances, and they tried to scare people away. And they succeeded, in part.”

The most powerful part of the movimiento remains the PAH—the Platforma de Afectados por la Hipoteca (Platform for those Affected by the Mortgage).

“The numbers affected by evictions are huge, incredibly huge. The PAH movement actually started before the crisis, defending the rights of people who were unable to afford a mortgage—then in 2008 the speculative housing bubble burst, and it transformed itself into something that defended the rights of people facing eviction because of the crash, going to places where people were being evicted, blocking evictions. Many, many people started to participate in it, and it became quickly linked with the indignados movement and the local assemblies. But because the PAH were working for a very specific thing, they were very successful in terms of receiving support, because everybody saw that this was a very precise thing that could be aimed for, changing a specific law on housing—and keeping people from becoming homeless. Because of that we have the support of eighty percent of Spanish society.”

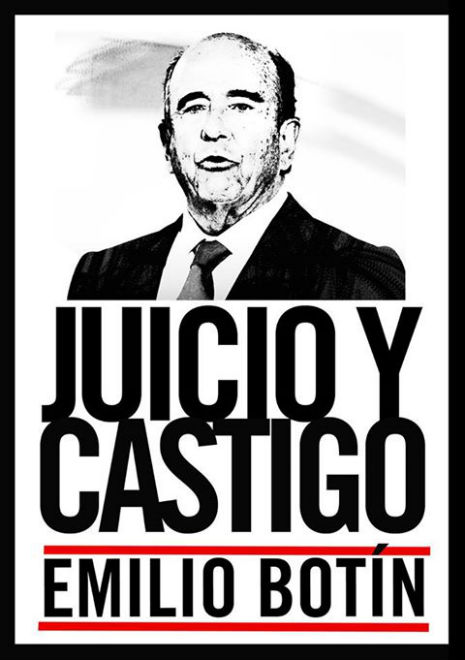

Banker Emilo Botin and his “juicy booty”

This specific change in the law, Marc explains, was to “approve the dation in payment”—in other words, your debt would be cancelled when you lost your dwelling. The PAH gathered 1.4 million signatures to petition for this change, which was rejected by the government in April.

“This was denied because it generates a problem for the banks, who receive a property without value and don’t have any other way to recover the money they have lent. This is not important for the Spanish banks themselves, but for the European banks—German ones mainly—who were behind their capacity to give credit.”

On Friday Sara and I visit the working class district Encants to see the PAH in action. This requires a strange early evening journey, through somnolent shopping centers and amnesiac underpasses, until Barcelona finally cuts the shit and we find ourselves in breezeblock central: vacant balconies jut out from the dull high apartment blocks, like the handles of empty filing cabinets.

We approach what might be a club or a bar—a large crowd mills about on the pavement outside smoking and talking. It is the local PAH center, though, and we enter a large, swelteringly hot space, with raw concrete walls plastered in printouts, schedules and slogans. It is packed. Over three hundred people are sitting close together, fanning out around a small panel of middle-aged, robust, blonde women, who are passing a microphone to and fro and filling the space with echoing bursts of musical, exhortative Spanish.

Clearly this entire audience is facing eviction—eviction and a lifetime of debt. It’s no small burden. Just a few months ago a forty-seven-year-old woman walked into her local bank in Valencia and set herself on fire. (She survived, just about.)

Here, though, there is something in the atmosphere besides tension, something like relief. Eviction, penury—these are definitively lonely ordeals, and through the PAH people can find emotional, practical and political support and solidarity.

My assumption, as I watch the panel move through the endless succession of questions—everyone here has at least one—is that it consists of pro bono professionals. Apparently not. “They are not qualified,” whispers Sara, “they are just normal, working class women, but they sound like property lawyers.”

These panelists, it transpires, know every twist in the labyrinth because they were lost in it themselves, and so by necessity became expert at frustrating and thwarting the banks. In the week the PAH holds separate surgeries for the victims of the separate banks, organize sit-ins to stop evictions, and protest at the banks. They have been awarded a European Citizen of the Year award from the European Parliament, and enjoy—it warrants repetition—over 80% support from the public.

Pau Faus, Barcelona PAH

The Spanish government, meanwhile, has compared the PAH to ETA, to terrorists, to Nazis, and wants to see them stripped of their award…

This hysterical reaction was in response to escrache, a PAH approach that brought protest to these politicians’ literal doorsteps. However, it ain’t hard to see why the PAH might make the Spanish establishment generally nervous. In reality, there is nothing “apolitical,” say, about their guiding asservation that “having a home is a basic right,” or about their effort to remove the unjust financial yoke so cynically fastened upon the necks of hundreds of thousands of Spaniards. On the contrary, such ideas and actions are potentially revolutionary.

A hesitant African woman stands up. Her bank, she explains, are offering her a so-called “social rent” (whereby you lose your home but can go on living there). This is a very rare concession, so rare that it inspires one of the panelists to stand on her toes and flamboyantly flap her “Si Se Puede!” t-shirt high enough to flash the audience a glimpse of her bra.

Laughter flows through the crowd and out onto the pavement. The noise level instantly rises, interfering with the discussion and sparking a collective shhhhhh. It carries a hint of the Spanish lisp, this shhhhhh, making it sound more like a hiss than a hush, and this crowd of debtors, activists and volunteers a very large, very angry snake.

I remember what Marc said yesterday about the movimiento needing leadership, and wonder what on earth could happen if it finds it.

Masses of thanks to Sara, Moritz, Marc & Rebecca

(Palgrave/MacMillan, NYC). A previous essay from Mr. Sheahen, “Jobs are not the answer: The BIG idea that libertarians and socialists alike can agree on?” was published at Dangerous Minds last week and proved to be very popular.

(Palgrave/MacMillan, NYC). For more information, go to www.basicincomeguarantee.com