This is a guest post from Charles Hugh Smith. His newest book is Why Things Are Falling Apart and What We Can Do About It

The crisis of capitalism has not been resolved; it’s simply been papered over.

First, a disclaimer: this is an interpretive discussion of some aspects of Marx’s analysis (which was based on the capitalism he observed in the late 19th century) applied to present-day cartel-state capitalism. It is not a scholarly or academic presentation.

The discussion covers a lot of ground, though, so please refill your beverage container and strap in….

That Marx’s prescription for a socialist/Communist alternative to capitalism failed does not necessarily negate his critique of capitalism. Marx spent hundreds of pages analyzing capital and capitalism and relatively few sketching out a pie-in-the-sky alternative that was not grounded in historical examples or working models.

So it is no surprise that his prescriptive work is an occasionally risible historical curiosity while his critique stands as a systemic analysis.

Marx got a number of things right, one of which appears to be playing out on a global scale. You probably know that Marx expected capitalism to experience a series of ever-larger boom-bust cycles that would eventually precipitate revolution and overthrow of the existing financial-political order.

One driver of these cycles was the interplay of increasing production and declining labor costs. In broad-brush, Marx recognized that industrial capital (as opposed to finance capital) could only increase profits and accumulate more capital by raising production and/or establishing a price-fixing cartel or monopoly.

Mechanization characterized industrial capitalism in the late 19th century, and Marx observed that as mechanization increased productivity, the marginal value of labor decreased on a per unit basis.

Here is a real-world example: When I first visited China in 2000, there was a massive glut of television production: the capacity to manufacture TVs had expanded far beyond China’s domestic demand for TVs. To wring out a profit in a highly competitive industry, manufacturers had to ramp up production while lowering the unit cost of labor and the unit cost of each TV to undercut the competition.

If an assembly line of 100 workers could produce 1,000 TVs a day, the only way to lower the price of the TV is to either lower the wages paid to the workers or invest capital in machinery that enables the same 100 workers to produce 2,000 TVs a day.

At 2,000 TVs a day, the per unit labor cost falls in half. For example, at 1,000 TVs a day, the labor cost per TV might be $40. At 2,000 TVs per day assembled by the same 100 workers, the labor cost per unit drops to $20.

The key point here is that labor’s share of the total production cost declines. If workers had taken home $1 million in pay to make 100,000 TVs at the old production rate of 1,000 TVs/day, they now take home $500,000 to make 100,000 TVs at the new production rate.

In other words, labor’s share of value creation constantly declines as mechanization boosts productivity. Marx described the impact of another factor: oversupply of labor. As rural agricultural workers flooded into cities for jobs that paid cash, there was an abundance of factory labor. Competition for jobs pushes wages lower, so workers faced a double-whammy: their share of production relentlessly declined as productivity rose, and the pressure on wages constantly rose as per unit labor costs declined.

The competition to outproduce industrial rivals with cheaper per-unit production costs and labor’s competition for jobs both generate a structural crisis in capitalism: as production of goods rises, both the cost per unit and the number of workers earning enough to buy the goods declines.

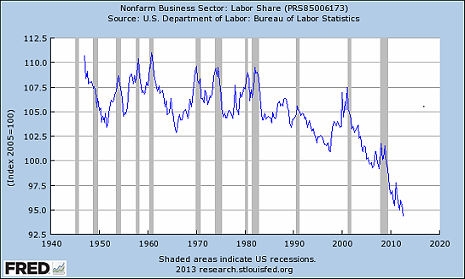

Lowering the cost of the TV no longer sells units if there are not enough workers with jobs to buy them. If you think this is only a 19th century or developing-world phenomenon, please examine this chart:

This chart shows that labor’s share of the economic output is declining sharply. The reasons? The same two Marx identified: a surplus of labor and declining per unit labor cost. In effect, the economy produces more goods and services with less labor. Since the demand for labor is declining while the supply of workers increases, competition drives wages lower.

The crisis Marx foresaw appeared to unfold in the 1930s, but the expansive central state became a Savior State, marshalling its ability borrow huge sums of money to create demand by fiat.

In the postwar boom, the low-productivity service sector expanded as labor shared the bounty of cheap energy and rising industrial productivity.

Increasing cost of energy and marginal returns pushed capitalism back into crisis in the 1970s, but three forces emerged to increase labor’s purchasing power:

1. The discovery of supergiant oil fields in Alaska, the North Sea and Africa.

2. Computerization improved the productivity of the service sector.

3. Financialization of the developed economies artificially boosted the purchasing power of labor and finance capital via highly leveraged debt and declining interest rates.

All those forces have been spent. No new supergiant fields have been discovered in the past 20 years, and while improving technology is extracting more oil from existing fields, that is maintaining global production rather than ramping it up by 25%-50%.

Digital technologies, software and automation have reached the point that capital is able to replace or reduce service labor in virtually all sectors of the economy. What happened to assembly-line jobs in the 1960s-70s is now happening to service-sector jobs.

Financialization has reached diminishing returns: interest rates are near zero and stagnant incomes cannot service more debt. Leveraged debt and phantom collateral have created shadow banking systems which are largely outside state control and vulnerable to systemic shock.

In effect, the Marxist crisis in capitalism has re-emerged. The “fixes” of declining energy costs, more service jobs and leveraging debt have run their course.

Though Marx didn’t use the term rentier skimming operation, he described the mechanism in other terminology. Finance capital also plays a role in the emerging crisis of capitalism, as finance capital (aided immensely by the Federal Reserve /central banks and the Federal government /central states) uses its access to nearly-free credit to buy assets that generate rents without having to produce any goods or services.

By way of example, consider the recent purchase of thousands of rental homes by institutional investors. Finance capital buys 10,000 homes and rents them to people who earn their income from their labor. Finance capital is not producing any good or service; is collecting rent from labor, i.e. a rentier skimming operation.

Cartels are also rentier skimming operations, as the cartel price reflects the cartel’s pricing power rather than the market value of the good or service. What is the market value of healthcare in the U.S.? Since healthcare is dominated by cartels, market pricing is purely for show: if you want to buy health insurance, there are only a few providers, and the price is roughly the same.

ObamaCare simply institutionalizes the healthcare cartels.

What is the value of a top-line fighter aircraft? Since there are only two producers left in the U.S., the price is understandably sky-high from either provider.

Care to guess the market value of TV/Internet service in areas served by one corporation? There is no competition, so the market price is undiscoverable. What’s provided is priced by the cartel or monopoly.

The key feature of cartel-state capitalism is that increases in price do not reflect an increase in value provided, they only reflect an increase in rentier skimming. In effect, eliminating competition is the only sure way to maintain profits and accumulate capital. The best way to accomplish this is to influence the state to impose or support one’s cartel.

This further squeezes those with jobs, as rentier skimming transfers more of their dwindling earned income to cartels. Since the State acts as the bagman for cartels, rising taxes are simply another form of rentier skimming.

You see the crisis brewing: Earned income is under pressure and labor is in structural decline. The only way the system can maintain demand for goods and services is either cash transfers from the Central State or loans extended to those with enough earned income to service more debt.

Once their ability to service more debt vanishes, so does demand for goods and services.

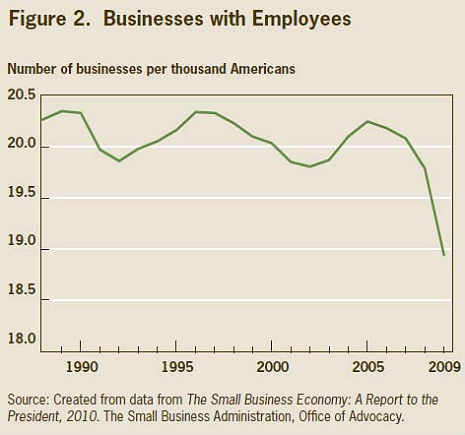

The rentier skimming of finance capital and the increasing productivity /decreasing need for labor both crush small business. When a rentier skimming operator buys commercial property, rents for small businesses instantly rise, driving out all but chain stores and stores catering to high-margin luxury markets. As the number of workers with discretionary income declines, labor’s support of small businesses also drops.

Once a niche market becomes profitable, a high-volume corporation will step in and either buy up the small suppliers or source lower-cost goods from its global supply chain and undercut the small producers.

This dynamic is clearly visible in the erosion of self-employment and small business:

This is the result of competitive squeeze and finance capital’s access to limitless cheap credit:

All this creates a problem for the Savior State, which must provide incomes to unemployed labor and protect politically powerful cartels. The only way the State can placate labor, industrial capital and finance capital is to keep interest rates very low and borrow $1 trillion a year to fill the structural gap between tax receipts (based largely on earned income, which is in relative decline) and State spending, which must rise as labor’s share of the economy dwindles and the demands of banks and other cartels constantly expand.

This state solution to capitalism’s structural crisis only works if interest rates remain low and the buyers of state debt believe their capital will be returned to them at maturity. Once it become clear that their capital cannot be returned (or the money returned to them will be heavily depreciated), the only marginal buyers of state bonds will be central banks which can print money to buy state debt.

This “solution” doesn’t resolve either the crisis of capitalism or the state’s structural deficits; it simply papers over these crises with financial legerdemaine.

This is a guest post from Charles Hugh Smith. His newest book is Why Things Are Falling Apart and What We Can Do About It