In The Objectivist Newsletter: Vol. 4, No. 12, December, 1965, Ayn Rand published an essay titled “Check Your Premises: What Is Capitalism?”

In part 2 of the two-part article, Rand asked her followers:

“Why should Elvis Presley make more money than Einstein?” The answer is: Because men work in order to support and enjoy their own lives-and if many men find value in Elvis Presley, they are entitled to spend their money on their own pleasure. Presley’s fortune is not taken from those who do not care for his work (I am one of them) nor from Einstein—nor does he stand in Einstein’s way—nor does Einstein lack proper recognition and support in a free society, on an appropriate intellectual level.

Fair point, zealous defender of Capitalism crazy lady!

But how to square that argument against one of the single most egregious examples of corporate greed-headism that I have perhaps ever heard of in my entire life?

I don’t think it can be done.

In the past few days, articles relating to the outrageous compensation package paid to one John H. Hammergren, the CEO of the McKesson Corp., a giant medical-supply wholesaler based in San Francisco, have been popping up in different places around the Internet.

The Daily Beast’s Gary Rivlin referred to Hammergren as “...one of the nation’s highest-paid CEOs—and you’ve never heard of him.” That was true for me, too, at least until yesterday, but apparently he’s been hiding right in the open. Hammergren ranked 14th on Forbes’s 2011 executive-pay list and 22nd the year before.

I think at this point, though, Hammergren’s cover has been definitively blown:

Since taking over as the CEO of McKesson—which is the main pharmaceutical supplier to large retail chains like Wal-Mart and Rite Aid, hospitals and nursing homes—in 1999, when the previous management was ousted in an accounting scandal, Hammergren has made $500 million dollars.

That’s even more than the $442 million McKesson has set aside to settle a class-action lawsuit that was brought against it, charging that McKesson conspired to drive up the price of prescription drugs!

Read those last two paragraphs again, won’t you? How DO they set the wholesale costs of drugs, anyway?!?!? Not that these two matters have anything to do with it…!

From The Daily Beast:

For a moment, [New York-based compensation consultant, James] Reda is silent. “$40 million, $50 million a year is excessive, no matter what the yardstick,” he says. The average pay package for a CEO running a top 100 company these days, Reda says, is around $12 million. That includes everything, from salary to stock awards to contributions to a retirement account. Yet last year McKesson contributed more than $13 million just to Hammergren’s pension, according to company documents. Among the other perks he enjoys: a chauffeur to drive his company car, free use of the corporate jet for personal travel, and an extra $17,000 a year to pay for a financial planner because handling all those hundreds of millions is no doubt complicated stuff.

“He doesn’t leave anything on the table, does he?” Reda asks.

Ya, think?

Now if you’ve ever gotten a medical bill for a $4 Q-tip or a $3 cotton ball, or you pay out-of-pocket each month for expensive pharmaceuticals to keep you alive, it might make you puke to realize that, well, considering the simple rules of mathematics (no higher authority is required here) there is a very high likelihood that you personally might be paying some small part of this fat cat’s income each and every month, because he’s quite literally making a killing—FROM SICK PEOPLE!

Perhaps buried in the price of each and every pill or injection that you yourself might take, is a contribution to the upkeep of the cushy lifestyle of this great and powerful MAN-GOD, the great John H. Hammergren.

How fucked up is that? Talk about getting your cut, right?

Welcome to free-market healthcare in America the Great! This farce is advanced capitalism as the lowest rung of a Dantean Hell: I picture a hive of SICK worker bees chained to their honeycomb to produce royal jelly for the queen bee, or king bee in this instance, so they can live on to do it yet another day.

How much more visceral of an example would you require to convince you that the system is completely rigged for the wealthy?

Hell, this goes so far beyond that, it’s the fucking MATRIX, here and now!

.

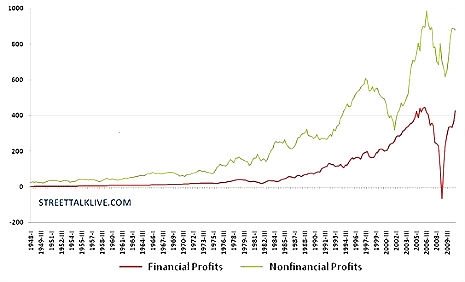

Ever wonder why the costs of American health care are the highest in the world? I don’t, I’d just like to know how many more capitalist parasites like Hammergren there are taking their own cuts off the top of prescription medicine sales in this country, wouldn’t you? Makes you wonder HOW MANY OTHER PIGS ARE FEEDING AT THE BIG PHARMA TROUGH in a similar manner, doesn’t it?

Poking around, I saw that Hammergren’s compensation package has been questioned before, as Patrick McGeehan wrote in “Suits: The Pension’s In the Bag” published in the The New York Times on June 17, 2007:

John H. Hammergren has plenty of incentives to stay on as chairman and chief executive of the McKesson Corporation, the health care services giant based in San Francisco. But to pad his pension is not one of them.

Mr. Hammergren, who after six years as the chief executive is only 48, could quit tomorrow and immediately collect full pension benefits as if he had worked until retirement. How large would that lump sum be? Almost $76 million. McKesson disclosed that obligation in its latest proxy statement, though it said it had accounted for only about $35 million of it.

So if Mr. Hammergren resigns abruptly, shareholders will have 40 million more reasons to miss him.

But it keeps getting more and more absurd. Via The Daily Beast again:

“As far as I’m concerned, a board that keeps loading up its chief executive with more stock and options each year is, from a shareholder perspective, basically committing theft,” says Albert Meyer, a former accounting professor who runs a money-management firm called Bastiat Capital. It’s all legal, of course, but to Meyer you can tell if an enterprise exists for the benefit of shareholders or insiders by the number of options it awards its top executives. Options aren’t free; they dilute the worth of everyone’s shares. And the practice hurts more than the privileged few. Anyone who owns an index fund of the country’s 500 largest companies owns shares in McKesson, a Fortune 500 company. “It’s nothing short of a massive wealth transfer from the retirement accounts of middle-class Americans to a privileged few,” hidden in the guise of stock-option programs like McKesson’s, Meyer argues.

—snip—

The party won’t stop once the 52-year-old Hammergren retires. Among his lifetime benefits: a personal assistant and office, which the company figures will cost more than $200,000 a year, and the services of a financial counselor—a perk that will eat up $350,000 in profits, according to company estimates. The goodies keep coming even after he dies. If his wife survives him, she will continue receiving his base salary for six months and will also get $2 million in cash. That cash bonus would actually cost the company nearly twice that amount, as it’s promised to cover the widow’s cost of paying taxes on that money.

Okay, I’m sure that you must have a pretty good idea of what’s going on here by now. But do you really want to feel the love?

If Hammergren loses his gig because the company gets sold or there’s a stock takeover, he would get a $469 million payout. If you were him, wouldn’t you work like hell to make sure that happened? What kind of crazy, fucked up performance incentive is THAT?

And this means, of course, that FUTURE sick people will be able to pay that windfall down on McKesson’s behalf, with each and every month’s pharmacy bills!

It’s obscene, isn’t it?

Fox News and the Republican party would call this guy a “job creator.” I call him a parasitic greed-head, growing rich off sick people.

But for all of you Fox News watchers who also read DM, I’ll put it to you another way:

HOW is a compensation package like this NOT A HIDDEN TAX on people’s very lives? It’s free-market tax just on staying alive, paid “freely”(!) to the top executive of this corporation! How could this be seen otherwise, even by the very thickest people out there???

What has THIS GUY, this MAN-GOD John H. Hammergren done that is so great that he deserves some micropayment on your illness? Why is something like this allowed to happen?

It’s positively feudal!

Am I exaggerating here for comic effect?

Replace “arable land” with “pharmaceuticals.”

“Serfdom” with “a hospital stay” or “managing a chronic disease.”

The king’s men come around for a micropayment every time you pop a pill, bucko. How’s this any different? How much choice do you have in the matter? What, you’ll show the king and stop taking the meds that keep you going?

Here’s the thing, like Ayn Rand, I have no trouble with guys like Larry Ellison or Bill Gates or Larry Page (who all started their companies) or even the bloody Kardashians getting rich selling stuff that people want. No one forces any of us to buy any of their products, of course [How much they should be taxed on these vast fortunes is not a subject for now, but in brief, I think “a hell of a lot” should cover it]. But why the fuck should MAN-GOD John H. Hammergren get a micro-payment “tribute” each and ever time someone in the customer, um, “food chain” of the McKesson Corp. has to take a pill?

That’s “freedom” ain’t it?

It’s quite incredible to consider that this ONE MAN’S SALARY could literally raise the price of prescription drugs in this country.

And gosh darn it, why aren’t the major stockholders getting a cut like this, too? OR ARE THEY?

This is what happens when the profit motive is introduced into places where it should not be. Like healthcare. It’s a moral affront, nothing less.

I leave you with this: Guess who approves his own compensation package? Hammergren is the chairman of the board, too!

The board votes on it when he’s out of the room, sure, but guess who is setting their salaries, suckers?

The system is rigged… not for your benefit.