The London offices of Shell, BP, Statoil and Platts, the world’s leading oil price reporting agency, were raided yesterday by European Commission inspectors, investigating allegations of collusion in price-fixing over the past 11 years.

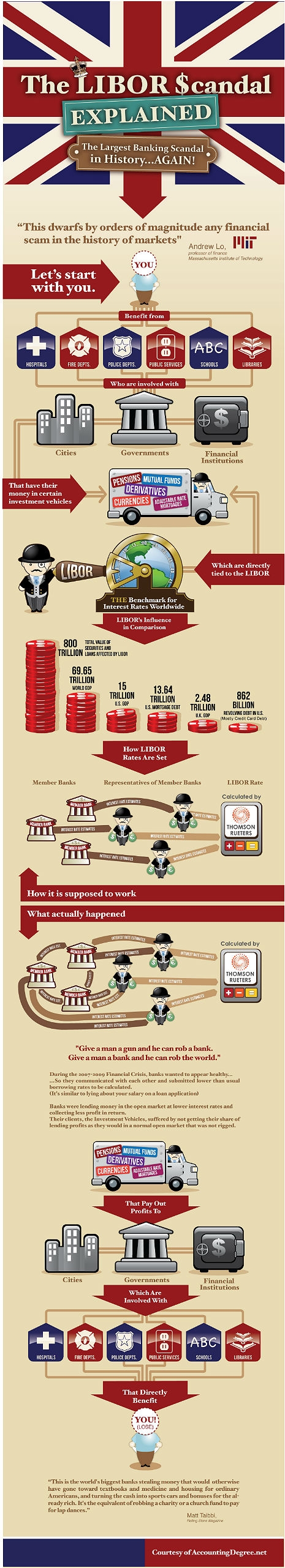

After last year’s Libor scandal, these new allegations of price-fixing look set to be a further damning indictment (if ever that were needed) of capitalism and the unfettered greed of its corporations.

If the allegations are true, then it again shows how prices are based NOT on true cost, but on an arbitrary figure dreamed-up to give as much money to a selfish, spineless, avaricious few.

The price people pay for oil is based on a “benchmark” which is calculated by price reporting agencies based on data received from firms such as oil companies, banks and hedge funds, which all trade oil on a daily basis. It is these submissions which the EC suspect are possibly fraudulent.

A spokesman for the European Commission said:

“The commission has concerns that companies may have colluded in reporting distorted prices to a price reporting agency to manipulate the published prices for a number of oil and biofuel products.

Officials carried out unannounced inspections at the premises of several companies active in and providing services to crude oil, refined oil products and biofuels sectors.

Even small distortions of assessed prices may have a huge impact on the prices of crude oil, refined oil products and biofuels purchases purchases and sales, potentially harming final consumers.”

The price fixing of fuel just doesn’t hit drivers—everything that is dependent on road haulage is directly affected by such underhand collusion—food prices, heating, public transport costs—all are increased and the costs will always hit the poorest worst.

According to the Guardian, Lord Oakeshott, former Liberal Democrat Treasury spokesman, said:

the alleged rigging of oil prices was “as serious as rigging Libor” – which led to banks being fined hundreds of millions of pounds.

He demanded to know why the UK authorities had not taken action earlier and said he would ask questions of the British regulator in Parliament. “Why have we had to wait for Brussels to find out if British oil giants are ripping off British consumers?” he said. “The price of energy ripples right through our economy and really matters to every business and families.”

As yet, there is no fixed date for the conclusion of the EC investigation. Read the full story here.

Previously on Dangerous Minds

Why the Libor Scandal is the most important story in the world