The Secret Teachings Of Sam Walton

How do we give form to the formless? How do we name that which is unnameable? How do we describe the indescribable? These are challenges that religion, the occult and magic have addressed since humanity first appeared on this planet. In an effort to communicate the divine, the transcendent, the psychedelic, we use devices like art and ritual. We cloak the mystical in words and images in the same way that GOD cloaks itself in the visible world to tell its story. Is life a great metaphor representing something that we cannot see, but know is there? Anyone who has had a “spiritual” experience has had a glimpse into, or a sense of, something greater that we are all a part of. Some go toward this experience alone—St. John or Jesus. Some go as a group, feeling that the odds are better that someone among them will serve as antennae, to dial into the radio of the gods and share the signal. These groups require focus and ceremony (a process) in order to cement the bonds of community, to attain a group consciousness that elevates one and all. We see this kind of collective mindset in everything from sports to business teams to religious organizations. But communities we don’t understand, that we deem weird or esoteric, we pejoratively call “cults.” The fervent devotion of sports fans, the mind-obliterating, soul-destroying Wal-Mart cheer forced upon its employees, the idolization of Steve Jobs and sheep-like behavior of Deadheads, Ben Carson and his groupies for God, all have cult-like aspects to them. But we dare not call them cults. We reserve the word to marginalize and demonize spiritual movements we do not understand or forms of art considered degenerate. “Cult” is a dirty word.

Confessions Of A Teenage Hippie Pervert

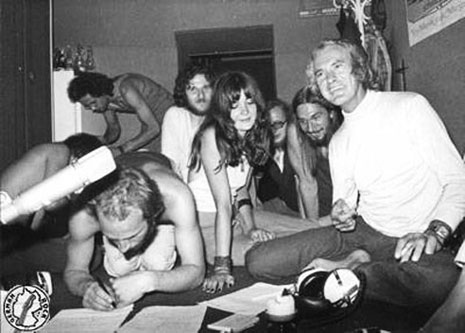

I’ve often wondered if I’ve ever been a cult member. During the Summer Of Love I lived in the Haight with a dozen or more teenagers my age who dropped acid, fucked each other and danced to psychedelic music in the glow of black lights and incense haze. We chanted “OM” and passed joints and waited for some kind of magic to happen. And it was happening. It just wasn’t the dramatic type of magic we were hoping for. I do think we collectively levitated once. I lived in a Los Gatos home owned by an ordained priest of The Church Of Tomorrow. He had the best LSD and his stream of consciousness talks seemed to be filled with all kinds of mindblowing heaviness. He had a gravitational pull that seemed superhuman. Young beautiful women flocked to him and I flocked to them. Was this a cult or was it just a groovy hangout? I lived in L.A. in 1967 and worked for a telemarketing agency (definitely a cult) and my young longhaired co-workers were the kinds of Southern California hippies that seemed more like extras from Beyond The Valley Of The Dolls than actual hippies. I spent a night tripping with them in a suburban ranch house and all they talked about was having rough sex with each other involving beatings, leather and whips. I love all kinds of sex, but this talk was brutal, chilling. The words coming out of their mouths were ugly, flailing through the room like syntactical succubi. What the fuck was I hearing? I fled the scene and ended up having a seriously intense trip in a telephone booth trying to call the only other people I knew in L.A. to come rescue me.

To this day I’m not sure that what I experienced with those “kinky perverts” actually happened. I may have been projecting my id into the situation, my repressed fantasies. After all I was raised in one of the biggest cults of them all, Catholicism. Were they a sex cult? Was what I was hearing all in my own head. Cults are crazy that way. They’re open to interpretation and are often victims of what people think they’re perceiving as opposed to what’s actually happening. Cults are often the repository for the desires we fear. And some cults are created to fuck with those fears, fantasies and projections.

Processeans

Altamont: Hitler’s Woodstock

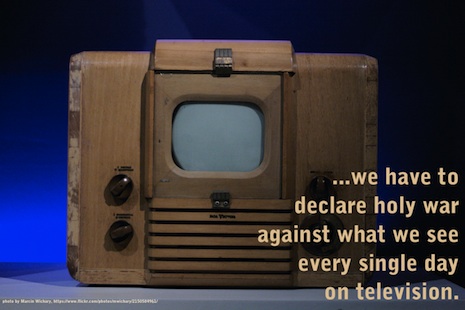

The French surrealists and dadaists employed occult imagery to shake up the status quo.They were called a “movement.” They could have just as easily been called a cult. New York’s Living Theatre used confrontational ceremony and transgressive ritual to tear apart the restraints that bound their audiences to dead and archaic modes of thinking. As a theater group, they worked intensely and constantly with each other and often lived communally. Were they a cult? Was Altamont the biggest black mass ever held and were those of us who attended unwitting members of some kind of Satanic sacrifice? (I was there. It sure looked like Hell to me.) Is Facebook the ultimate cult, dwarfing any cult or religion known to man or woman, unstoppable in its indoctrination of every living breathing human being on this earth? I see more devotion directed toward Facebook than any religion I’ve ever encountered. More people are facing their monitor screens than Mecca or reading from their Bibles.

The Living Theatre

Facebook: The Bible Of The Damned

Dr. Timothy Leary was vilified for turning on a generation of young people to the vast beauty and possibilities of their own minds. Mark Zuckerberg is celebrated for reducing our consciousness to the dimensions of a 14-inch screen filled with pictures of food, cats, obituary notices and forlorn pictures of aging rock and rollers. Jesus (who had a cult of just 12) was crucified for being a weirdo. Joel Osteen has made a fortune playing Jesus in a Brooks Brothers suit. Given the choice between Aleister Crowley or Ted Cruz for President, The Beast gets my vote. I always go with the Devil I know. They turned David Koresh and a bunch of innocent children torched to a pile of ash and yet war criminal Dick Cheney still walks among us, his mechanical heart still beating, his rictus smirk still mocking us all. Donald Rumsfeld lived in Taos, New Mexico within spitting distance of where Marshall Applewhite leader of the Heaven’s Gate suicide cult ran a health food restaurant. Did Rummy eat Beezlebub’s bean sprouts? Did he dream of weapons of mass destruction hurtling toward us like a comet. In a world where companies make billions selling video games (talk about cults) in which teenage boys roleplay as carjackers, murderers and thugs, a kid named Ahmed Mohamed was arrested for bringing a homemade clock to school. The mass hypnosis taking place in this world right now makes Charles Manson look about as intimidating as Chuck Woolery. Most Americans have been, and will continue to vote for a government that is actively working against their best interests. Under what spell have we fallen? We follow blindly, faithfully, surrendering our will to higher powers, both political and religious. Welcome to the biggest cult of them all: the United States Of America. Rant over.

Crazy Wisdom Drove Me Crazy

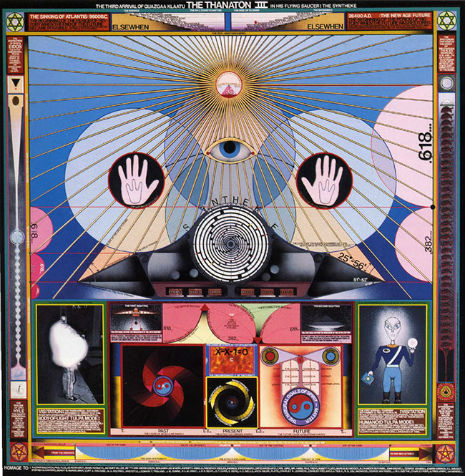

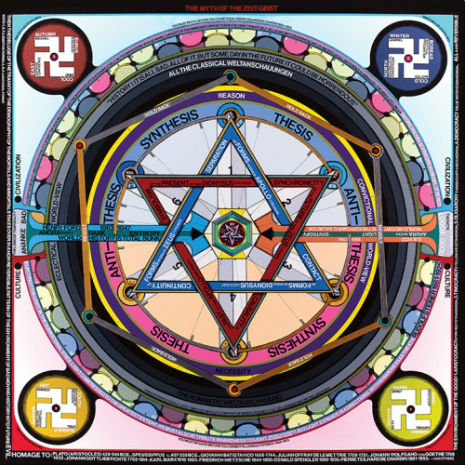

Back in simpler days when a cult was a cult and easily identifiable—they wore robes or funny hats—a group of young men and women gathered together in 60s London to form The Process, a quasi-religious group that were part spiritual seekers, part performance art and more than a little bit rock and roll. They had long hair, were beautiful and dressed like priests styled by a Carnaby Street tailor. Their methods were a mashup of Scientology, occultism, psychedelia, pop culture and dada. The members of The Process Church Of The Final Judgement were genuinely on a path to find out the answers to life’s most profound questions: how did we get here, what are supposed to do here and where the fuck are we going? But unlike most religious folk, the members of The Process realized that the journey was the goal and didn’t have to be deadly serious. The Process was all about the process. Enjoy it. In many respects it resembled Chogyam Trungpa’s teachings on crazy wisdom. I was a student of Trungpa’s. From an idiot’s point of view, Trungpa was a cult leader.

Chogyam Trungpa

Attack Of The Hooded Snuffoids

In their zeal to shake things up, The Process occasionally went off the deep end and this is where they ran into problems. People, particularly the British press, could not separate the theatrical from the real. And the The Process was very theatrical. Like Antonin Artaud or Andy Kaufman, The Process was adept at elaborate mindfucking. They were the mystical turd in the very bland punch bowl of British society. In mocking religious hypocrisy, they were often mistaken for being the very thing they were mocking. Their shock tactics often backfired. Surrounding themselves with the iconography of Satanism was a heavy metal move years before Black Sabbath had ever released a record. But try explaining that to the tabloids who called them Satan worshippers and sex deviants. Or worse, Ed Sanders’ hate-filled description of The Process as “hooded snuffoids” and “an English occult society dedicated to observing and aiding the end of the world by stirring up murder, violence and chaos, and dedicated to the proposition that they shall survive the gore as the chosen people.” I’m as big a Fugs fan as anyone out there, but Sanders really missed the irony of him, of all people, writing this shit. Sanders’ band The Fugs were themselves quite skilled in the art of the mindfuck. Using majikal incantations to Egyptian gods, The Fugs attempted to levitate the Pentagon in protest of the Vietnam war. When you’ve successfully conned a con artist like Ed Sanders, you’ve managed something to be quite proud of.

Power to The Process. And Ed, to quote the title of your once infamous literary ‘zine, fuck you.

Ed Sanders’ exorcism chant

Skinny Puppy Housebroken By Satan

While I’m not an expert on any of this cult stuff, like most people, I find it immensely fascinating. The Manson Family creeps me out in ways that deeply disturb me, although groups like The Source, The Process and even Scientology provide me the kind of amusement that diffuses some of the darker shit. If you want to delve further into The Process from the point of view of someone who knows far more than me and does it objectively and with just enough wit and empathy, check out filmmaker Neil Edwards’ insightful and thoroughly entertaining new documentary Sympathy For The Devil. Full of interviews with surviving members of The Process and various experts in the field of all things “cult,” Edwards’ film will introduce you to the real truth behind the head games, rumors, bullshit and theater. And as Edwards told me, like its subject, the movie is a work in progress. There is more to be told and probably more that will never be told.

After the jump, an interview with director Neil Edwards…

.jpg)