Does it seem odd to you that the Dow Jones Industrial Average is still north of 10,000 despite the fact that no one has any jobs, the economy is puking blood and a bruised and battered mainstream America long ago exited the stock market?

Why wouldn’t the stock market be thriving while the rest of us are on food stamps and living in tents? Wall Street and the banks got the bailout, they aren’t going to lend anybody anything and they are paying themselves FAT BONUSES with your tax dollars. Let there be no mistake about it. The financial class have tied up all the productive capital in this country and are skimming off the top to enrich themselves. That’s the way the game works. It’s all legal!

And it’s obscene. If the general population would stop watching Fox News and worrying about a “mosque” (that isn’t even a mosque) long enough to figure out how they’ve been fucked up the ass sans lube by the plutocrats, there would be rioting in the streets. Instead they think that what we really need are an extension of the Bush tax cuts for the wealthy and to repeal healthcare reform. (Shudders).

That’s why this new thought experiment/essay, by my super smart pal Charles Hugh Smith is so important to read and share with others. I was thrilled when I read this and I think you will be, too. Talk about a dangerous mind. Wow.

Think what this thought bomb, injected into the national conversation would do. Talk about this idea with your friends, post the essay on Facebook and call talk radio to seed this into the dialogue there.

Imagine if a meme like this spread and took hold. It could—easily—happen. It would turn the national conversation upside down! Now do your part!

What if the Fed and Treasury distributed $1.3 trillion directly to households rather than disburse it to prop up bank lending? At least some households would use the funds to pay down debt, meaning the money would flow to the banking sector anyway, but with one critical difference: household debt would actually decline, leaving household balance sheets in better shape and owing less interest every month.

With quantitative easing, the idea is to increase the debt load on households; with a helicopter drop of fresh cash, the idea would be to reduce the debt load that is crushing many households. Banks would benefit, too, as more consumer debt would be paid off in full compared to the current policy of promoting heavier debt loads. The negative consequences of pushing more debt on households is also obvious: more loans become uncollectible and go into default, creating more loan losses for banks.

If the cash transfers were broadly distributed, the subsequent spending would be more representative of sustainable demand than other means of stimulus, such as costly and ineffective “job creation” programs.

Most importantly, the status quo monetary policy distorts economic activity towards debt-based financial assets and debt-financed durable goods such as the “cash for clunkers” program to boost auto sales.

According to the status quo, adding more debt to households is the cure to our economic malaise. But for most households, high debt is the disease, not the cure, and adding more debt to “stimulate spending” is like trying to put out a fire with gasoline.

Some might argue that a direct deposit of freshly issued cash into households would be inflationary. But other economists argue that if inflation is a monetary issue, and a helicopter drop of cash is fundamentally fiscal, then the worry over sparking inflation is misplaced.

What seems clear is that expanding bank credit through quantitative easing policies of funneling trillions of dollars into banks isn’t working. Putting the same money thrown into banks ($4 trillion) into households’ accounts would certainly put the money where it could either be spent or used to pay down debt—both of which are direct “cures” to over-indebtedness and a no-growth economy.

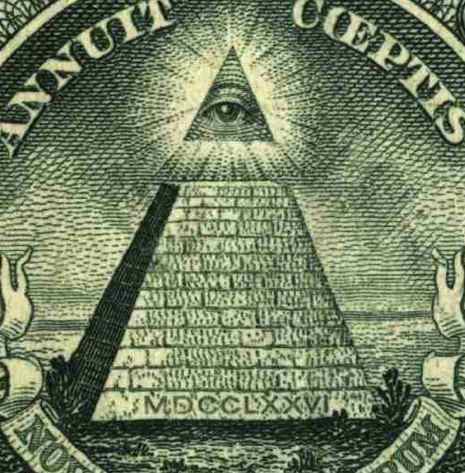

The sums of money squandered on bailing out banks are difficult to grasp. So I’ll make it easy: if the Treasury printed up $1.3 trillion in cash, that would be enough to give $10,000 to all 130 million households in the U.S.

Even $10,000 to each household would enable a lot of debt to be paid off. Those without any debt could save/invest/spend it. That would certainly do more for the economy than throwing another $1.3 trillion to “extend and pretend” the banks’ insolvency.

Would such a distribution set up a political expectation for another $10,000 next election cycle? Very likely. Would that be positive? No. But all policy is a series of trade-offs, and a helicopter drop could be “sold” as one-time only.

Would it trigger massive inflation? Doubtful. The national debt is about $13 trillion, so adding 10% to it with a “helicopter drop” is not going to change the long-term debt problem much. The GDP is around $13-$14 trillion as well, so it would amount to a one-time 10% boost in GDP. Total personal income is around $8.4 trillion, so a $1.3 trillion helicopter drop of cash would be about a 15% boost to personal income.

Would it really do much to lower indebtedness of the American consumer? No. Total debt in the U.S. is about $52 trillion—governmental, corporate and private. Mortgage debt is around $10 trillion, and consumer debt is around $2.4 trillon. (These are approximate; a web search will confirm the round numbers.)

While $1.3 trillion won’t do much to change the outlook for inflation or future debt crises, it sure would give a lot of households one last chance to set things on a more positive course. $10,000 could wipe out a high-debt credit card without wiping out the creditworthiness of the household, or it could finance a move to a locale with more employment. It could replace a vehicle on its last legs with a better used car.

Would some people squander a one-time “last chance to set a new course” helicopter drop? Of course some people will. But that’s not the point. The point is that the nation has received zero value from trillions in quantitative easing, and so if even 10% of the 130 million households do something useful with their $10,000 in cash then that would be one heck of a lot more than we’ve gotten from the trillions thrown down the rathole of a venal, corrupted, insolvent banking sector.

Throwing money at banks hasn’t done anything but reward financial Power Elites via privatizing their gains and transferring their losses to the taxpayers. Throwing money at households won’t solve the nation’s problems either, but it would give households a one-time chance to do something useful with a chunk of cash. If 90% of the households blew it, then it would still end up somewhere in the economy, which is more than can be said of the trillions thrown away on QE.

In the long run, it wouldn’t make much difference to the nation’s fiscal situation, but to households on the edge, it might make a very significant difference.

Read the entire essay

What If We Ditched Quantitative Easing and Just Printed (and Distributed) Cash? (Of Two Minds)

Posted by Richard Metzger

|

08.30.2010

10:49 am

|