With the news that a five-member panel of the FCC are considering creating a series of super powerful free WiFi network across America, it’s to be expected that the corporate lobbyists for the $178 billion wireless industry are already working overtime to scuttle these plans.

Conversely, according to The Washington Post, there has been an equally aggressive push coming from tech giants like Google and Microsoft for free WiFi networks “who say a free-for-all WiFi service would spark an explosion of innovations and devices that would benefit most Americans, especially the poor”:

The airwaves that FCC officials want to hand over to the public would be much more powerful than existing WiFi networks that have become common in households. They could penetrate thick concrete walls and travel over hills and around trees. If all goes as planned, free access to the Web would be available in just about every metropolitan area and in many rural areas.

The new WiFi networks would also have much farther reach, allowing for a driverless car to communicate with another vehicle a mile away or a patient’s heart monitor to connect to a hospital on the other side of town.

If approved by the FCC, the free networks would still take several years to set up. And, with no one actively managing them, connections could easily become jammed in major cities. But public WiFi could allow many consumers to make free calls from their mobile phones via the Internet. The frugal-minded could even use the service in their homes, allowing them to cut off expensive Internet bills.

In a country where Wal-Mart is the nation’s largest employer and doesn’t really even pay a living wage, this sort of monthly savings for what has become a necessity of modern life would seen quite attractive for the common man. The costs are surprisingly minimal, too.

But what of the poor, put-upon media barons who won’t be able to continue sticking the masses with a monthly cell phone bill? Should the management and stockholders of AT&T, T-Mobile, Verizon Wireless, Intel and Qualcomm be disallowed from skimming around a hundred bucks a month from the bank accounts of the average American?

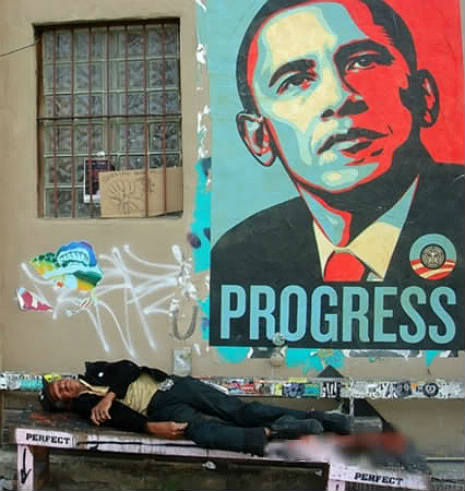

Of course, the wireless telecom and cable providers are determined not to let this happen. In a January letter to FCC Chairman Julius Genachowski, the architect of this ambitious plan, and a powerful member of the Obama inner circle, several major companies argued that the government should concentrate on selling the public airwaves to private business, and raising money for the US Treasury that way, rather than going with the free WiFi for all, option.

They would feel that way, wouldn’t that??? LOL.

Naturally, the Republicans are lining up behind this ridiculously blinkered, backwards “free market” approach. Who can forget watching the Tea party dolts who were against net neutrality—because someone on Fox News told them it was something “socialist,” I guess—and braying like buffoons for the privilege of being able to give more power to the telecoms, even if it would mean seeing their own monthly bills rise... because, um, THEIR FREEDUMBS were apparently at stake.

This is a different kind of free market entirely that we’re talking about, one that could alter American lives in profound ways, spurring great innovation and perhaps even unprecedented high tech job creation. The saying goes that there’s no such thing as a free lunch, but free WiFi is already occurring in New York City and parts of Silicon Valley. In January, Google announced that it was providing free WiFi for NYC’s Chelsea neighborhood (where Google is headquartered in Manhattan). Soon that will extend to indoor fiber optic wiring as well. Google also rolled out high-speed fiber-optic Internet coverage recently in the Kansas City area, with download speeds up to 1 Gigabit per second. That’s pretty good. In fact it’s approximately 200 times faster than your home broadband connection. It’s not five times faster, it’s 200 times faster. (So much for innovation among the cable companies themselves, eh?)

Google’s blazing fast fiber optic service is beginning to draw hi-tech start-ups to Kansas City. Who would have thought that would happen a few years ago?

Furthermore, the major wireless carriers own far more spectrum than would even be necessary to provide public WiFi, and it would also improve their existing wireless networks for their own consumers. The only downside for this is for a relatively tiny group of stockholders. The benefits for Americans overall? Well, they seem limitless in terms of what can be imagined from 2013.

Designed by FCC Chairman Julius Genachowski, the plan would be a global first. When the U.S. government made a limited amount of unlicensed airwaves available in 1985, an unexpected explosion in innovation followed. Baby monitors, garage door openers and wireless stage microphones were created. Millions of homes now run their own wireless networks, connecting tablets, game consoles, kitchen appliances and security systems to the Internet.

“Freeing up unlicensed spectrum is a vibrantly free-market approach that offers low barriers to entry to innovators developing the technologies of the future and benefits consumers,” Genachowski said in a an e-mailed statement.

He’s 1000% right. Although not seeing the economic benefits flowing upwards at first may discombobulate their tiny brains, how idiotic would even Republicans have to be not to see the logic of this decidedly free market approach? If they balk, they need to be reminded of what the earlier—but far more technologically limited, pre-PC, iPad and smartphone, of course—Reagan-era changes in the management of the public airways wrought for the economy.

This is a real us vs.against them situation. The fattest cats versus EVERYBODY ELSE. It’ll be interesting to see how this shakes out. It’s an idea that’s time has come—IF NOT, WHY NOT—and I don’t think it’s going to go away until there’s free Wifi for all. The cat’s out of the bag and it ain’t going back in.