One of the big “sacred cows” of libertarian “free market” Capitalism is the supposed “invisible hand” of the marketplace keeping supply and demand in line with the price of a particular commodity or service.

The problem is, it’s just a myth, albeit a persistent one.

Jonathan Schlefer writes at the Harvard Business Review, that there is no evidence for the invisible hand:

One of the best-kept secrets in economics is that there is no case for the invisible hand. After more than a century trying to prove the opposite, economic theorists investigating the matter finally concluded in the 1970s that there is no reason to believe markets are led, as if by an invisible hand, to an optimal equilibrium — or any equilibrium at all. But the message never got through to their supposedly practical colleagues who so eagerly push advice about almost anything. Most never even heard what the theorists said, or else resolutely ignored it.

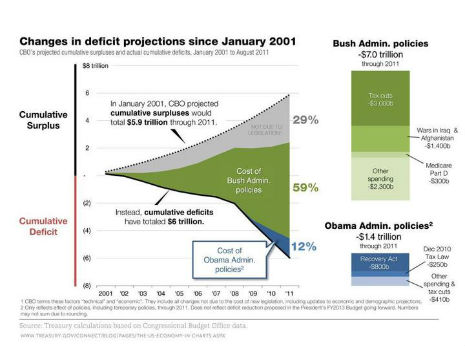

Of course, the dynamic but turbulent history of capitalism belies any invisible hand. The financial crisis that erupted in 2008 and the debt crises threatening Europe are just the latest evidence. Having lived in Mexico in the wake of its 1994 crisis and studied its politics, I just saw the absence of any invisible hand as a practical fact. What shocked me, when I later delved into economic theory, was to discover that, at least on this matter, theory supports practical evidence.

Adam Smith suggested the invisible hand in an otherwise obscure passage in his Inquiry Into the Nature and Causes of the Wealth of Nations in 1776. He mentioned it only once in the book, while he repeatedly noted situations where “natural liberty” does not work. Let banks charge much more than 5% interest, and they will lend to “prodigals and projectors,” precipitating bubbles and crashes. Let “people of the same trade” meet, and their conversation turns to “some contrivance to raise prices.” Let market competition continue to drive the division of labor, and it produces workers as “stupid and ignorant as it is possible for a human creature to become.”

That’s Adam Smith talking there, about 75 years before Marx and Engels wrote The Communist Manifesto!

Just saying….

The search by classical economists for a concrete and mathematically verifiable theory of economic equilibrium continued throughout the decades, but apparently no one could ever really find much evidence for it:

Leon Walras, of the University of Lausanne in Switzerland, thought he had succeeded in 1874 with his Elements of Pure Economics, but economists concluded that he had fallen far short. Finally, in 1954, Kenneth Arrow, at Stanford, and Gerard Debreu, at the Cowles Commission at Yale, developed the canonical “general-equilibrium” model, for which they later won the Nobel Prize. Making assumptions to characterize competitive markets, they proved that there exists some set of prices that would balance supply and demand for all goods. However, no one ever showed that some invisible hand would actually move markets toward that level. It is just a situation that might balance supply and demand if by happenstance it occurred. [Emphasis added].

In 1960 Herbert Scarf of Yale showed that an Arrow-Debreu economy can cycle unstably. The picture steadily darkened. Seminal papers in the 1970s, one authored by Debreu, eliminated “any last forlorn hope,” as the MIT theorist Franklin Fisher says, of proving that markets would move an economy toward equilibrium. Frank Hahn, a prominent Cambridge University theorist, sums up the matter: “We have no good reason to suppose that there are forces which lead the economy to equilibrium.”

Schlefer concludes by accusing the Federal Reserve of assuming market equilibrium would avert something like the subprime mortgage crisis—and being so wrong about it—precisely because their models incorrectly assumed equilibrium. That’s a hell of an overlooked variable! Of course when the economy did implode, the Fed responded with a flood of money and Keynesian tactics aimed at propping up the system.

But the misconceptions about the free market don’t end there. Have you heard of the “Minsky Moment”? Hyman P. Minsky? Don’t worry, you’re not alone. Most orthodox economists have never heard of him, either.

Hyman Minsky is the name of a once obscure “contrarian” professor of macroeconomics who died in 1996. A “red diaper baby” born to socialist parents in Belarus, Minsky spent the 1950s and 60s studying the causes of poverty. Throughout his entire career Minsky’s theories carried almost no weight in the field of economics. When the global economic crisis shook faith in the Capitalist system, his star began to rise. Minsky came to be regarded as “perhaps the most prescient big-picture thinker about what, exactly, we are going through” as the Boston Globe’s Stephen Mihm described him.

Minsky, Mihn wrote in 2009: “[P]redicted, decades ago, almost exactly the kind of meltdown that recently hammered the global economy.”

Minsky drew his own, far darker, lessons from Keynes’s landmark writings, which dealt not only with the problem of unemployment, but with money and banking. Although Keynes had never stated this explicitly, Minsky argued that Keynes’s collective work amounted to a powerful argument that capitalism was by its very nature unstable and prone to collapse. Far from trending toward some magical state of equilibrium, capitalism would inevitably do the opposite. It would lurch over a cliff.

This insight bore the stamp of his advisor Joseph Schumpeter, the noted Austrian economist now famous for documenting capitalism’s ceaseless process of “creative destruction.” But Minsky spent more time thinking about destruction than creation. In doing so, he formulated an intriguing theory: not only was capitalism prone to collapse, he argued, it was precisely its periods of economic stability that would set the stage for monumental crises.

Minsky called his idea the “Financial Instability Hypothesis.” In the wake of a depression, he noted, financial institutions are extraordinarily conservative, as are businesses. With the borrowers and the lenders who fuel the economy all steering clear of high-risk deals, things go smoothly: loans are almost always paid on time, businesses generally succeed, and everyone does well. That success, however, inevitably encourages borrowers and lenders to take on more risk in the reasonable hope of making more money. As Minsky observed, “Success breeds a disregard of the possibility of failure.”

As people forget that failure is a possibility, a “euphoric economy” eventually develops, fueled by the rise of far riskier borrowers—what he called speculative borrowers, those whose income would cover interest payments but not the principal; and those he called “Ponzi borrowers,” those whose income could cover neither, and could only pay their bills by borrowing still further. As these latter categories grew, the overall economy would shift from a conservative but profitable environment to a much more freewheeling system dominated by players whose survival depended not on sound business plans, but on borrowed money and freely available credit.

Once that kind of economy had developed, any panic could wreck the market. The failure of a single firm, for example, or the revelation of a staggering fraud could trigger fear and a sudden, economy-wide attempt to shed debt. This watershed moment—what was later dubbed the “Minsky moment”—would create an environment deeply inhospitable to all borrowers. The speculators and Ponzi borrowers would collapse first, as they lost access to the credit they needed to survive. Even the more stable players might find themselves unable to pay their debt without selling off assets; their forced sales would send asset prices spiraling downward, and inevitably, the entire rickety financial edifice would start to collapse. Businesses would falter, and the crisis would spill over to the “real” economy that depended on the now-collapsing financial system.

Sound in any way familiar?

If the “invisible hand” is just hogwash and if Minsky is right, what’s to stop the economy from imploding again?

Posted by Richard Metzger

|

04.19.2012

06:00 pm

|